Request for exemption

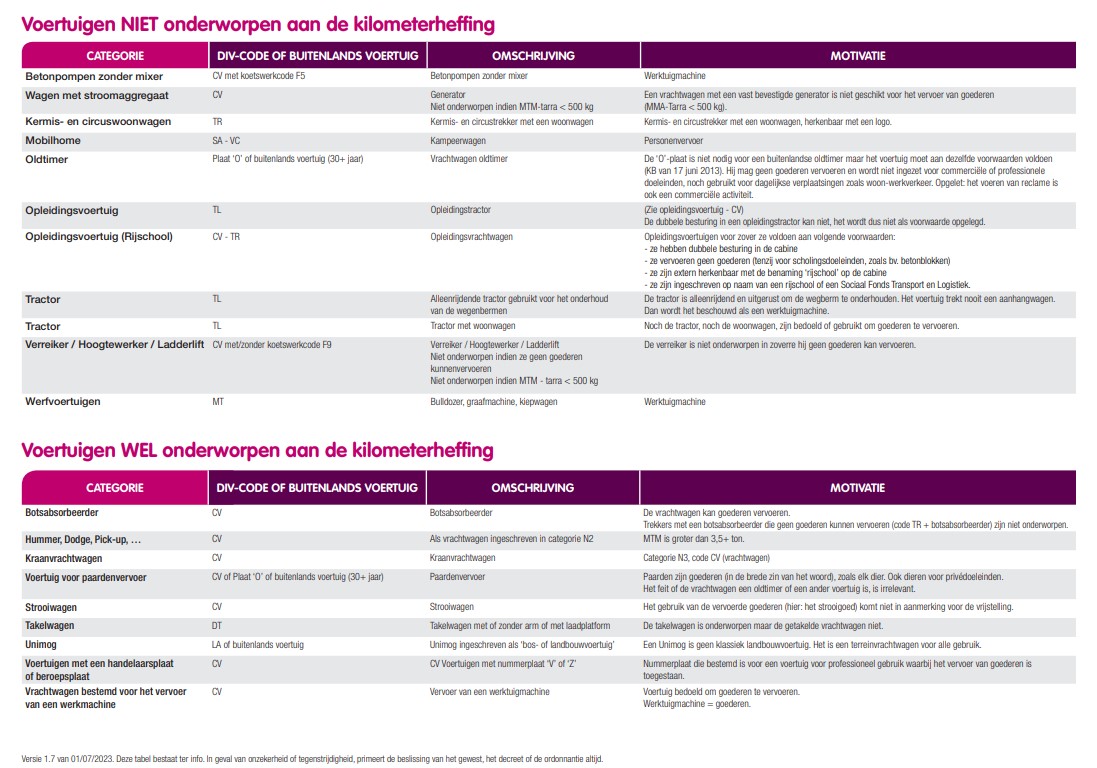

Certain categories of vehicles are exempted from Road Charging.They concern only the following categories:

- Vehicles used exclusively by the army, civil defense, fire department and police which are recognizable as such.

- Vehicles especially and exclusively equipped for medical purposes and recognizable as such.

- Vehicles of the agricultural, horticultural or forestry type using public roads in Belgium in a limited way and used exclusively for agriculture, horticulture, fish farming and forestry.

The owners of a vehicle of over 3.5 tons that falls into one of the exemption categories, must submit an application for exemption to the region where their vehicle is registered. To make such a request it is necessary to fill out a form and add a picture with front view and with side view of the vehicle. To do so you should go to the website of your region:

For the Flemish Region:

For the Brussels Region:

- fiscaliteit.brussels/kilometerheffing-voor-vrachtwagens-2016 (NL)

- fiscaliteit.brussels/prelevement-kilometrique-pour-les-poids-lourds-2016 (FR)

For the Walloon Region:

- Fill out the form on https://www.exemption.sofico.org/stark-exoneration. You will need a scan of your registration documents

For foreign vehicles:

If your vehicle is registered abroad:

- If your application concerns a vehicle of agricultural, horticultural or forestry type, fill out the form on https://www.exemption.sofico.org/stark-exoneration. You will need a scan of your registration documents

- If your application concerns a vehicle of the army, civil defense, fire department or police then click on this link belastingen.vlaanderen.be/formulier-vrijstelling-kilometerheffing

- If your request is about a medical vehicle: click on this link

Or send an email (not for vehicles vehicle of agricultural, horticultural or forestry type) with the details of your vehicle (license plate number, GVW, Euro norm) and picture of front and side view to exemptions@viapass.be.